The Digital Kit process started many months ago, and we have clients who have this big question: Is it possible to obtain the Digital Kit without VAT? And although their quick answer is yes, we must ask them the questions. exceptions, conditions and other possible scenarios.

At Artic Agency, we are committed not only to boosting the digitalization of your company through the Digital Kit, but also to guiding you on how to maximize the associated tax benefits, especially with regard to VAT. digital transition is a gateway to efficiency and competitiveness, and we want to make sure you take advantage of every aspect of this opportunity, including the tax benefits.

The Digital Kit, an initiative supported by European Union funds, provides small and medium-sized businesses, as well as self-employed individuals, with access to subsidized digital solutions. However, the following question arises: How is VAT handled on these grants?

Do I have to pay VAT on the Digital Kit?

The short answer is yes. Although companies benefiting from the Digital Kit receive financial assistance to implement digital solutions, current law stipulates that they must pay VAT on this assistance. This VAT, however, may be deducted in the next tax return, offering significant relief to beneficiaries.

VAT Relief: A Key Benefit

Although companies and self-employed individuals who benefit from the Digital Kit must initially pay VAT on the services purchased, this tax is deductible in the next tax return. This provision offers an opportunity to recover these costs, alleviating the initial financial burden and boosting the return on investment in digitalization.

Digital Kit Without VAT: A Possibility for Some

An interesting peculiarity of the Spanish tax system is the possibility that certain businesses may be exempt from paying VAT on digital services due to their special tax regime, depending on your location and the nature of the transaction. This knowledge is part of the comprehensive consulting we offer, always seeking the better tax conditions for our clients, regardless of their location.

Digitalization and Tax Optimization

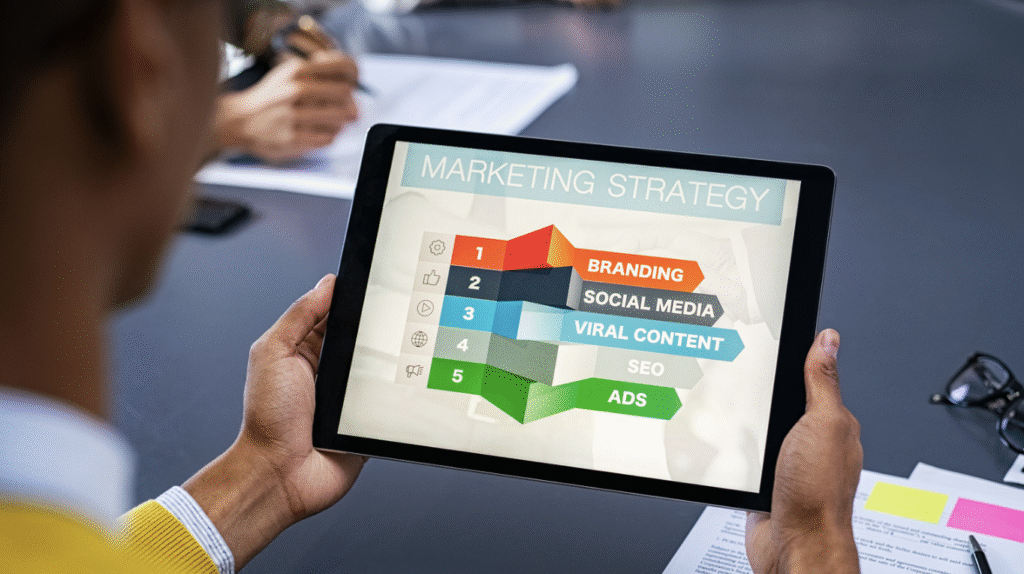

With Artic Agency, implementing the Digital Kit is just the beginning. Our 360º approach not only covers selection and implementation of the most suitable digital tools for your business, but also includes strategic planning that considers tax optimization, especially with regard to VAT.

From SEO and SEM consulting that improves your online visibility, to web maintenance that ensures the optimal functionality of your site, to effective social media management that connects with your audience.

By adopting the Digital Kit with Artic Agency, you are not only investing in tools and solutions that will transform your business, but you're also ensuring that every step is taken with a complete strategic vision, including VAT management and optimization. Our mission is to ensure that your digital transition is as profitable as it is transformative.

The Digital Kit offers an excellent opportunity for Spanish SMEs and self-employed individuals to advance along this path. However, efficient management of the VAT associated with the aid received is crucial to maximizing the benefits of this program. We support you every step of the way, ensuring that your company not only digitally transforms with the Digital Kit, but also takes full advantage of tax opportunities, such as tax relief and, in certain cases, VAT exemption.

We are here to make your leap into the digital future safe, profitable and fully utilized.

Do you want to manage your digital kit? We help you resolve your doubts. There is no management cost.

If you have any questions, don't worry, we have a free consultation for you. Contact us.